If you live in South Africa and have an android device, there's a pretty good chance you've already come across Moya.

Why?

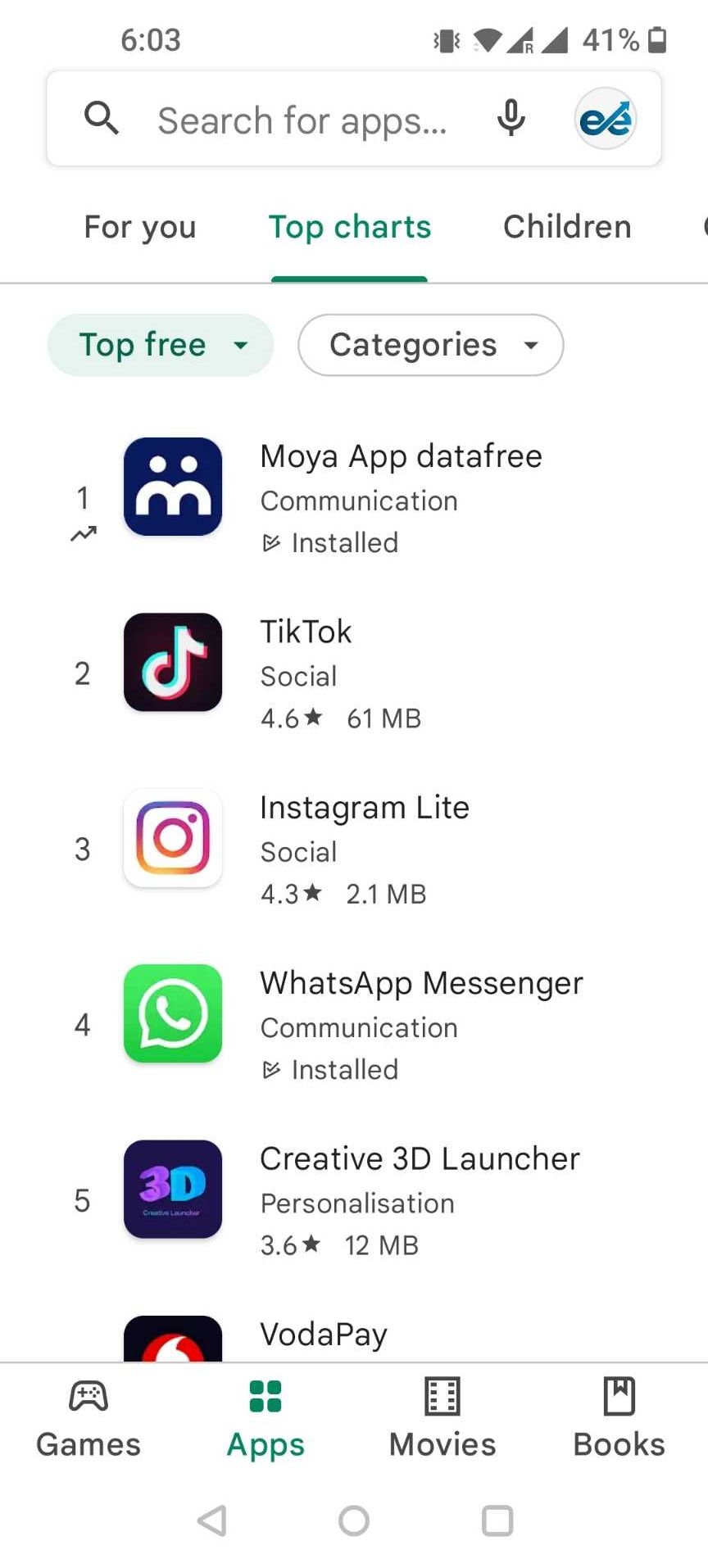

Well for starters, it's been downloaded by over 6.5 million South Africans, it consistently ranks top of the Play Store charts and many tech pundits wonder whether it could eventually usurp WhatsApp as Africa’s No. 1 messaging system.

Personally, I think there is a very good chance that this indeed happens, but I also think this prediction understates the potential benefits that an application like Moya can bring to South Africans and indeed many others from around the world.

You see although Moya offers messaging, and it’s listed as a communications app, its value proposition is actually to help end-users, i.e. everyday South Africans, to access a myriad of ‘data-intensive’ services, without incurring any costs.

That’s fundamentally different to WhatsApp, Signal and Telegram, as although they are advertised as free apps, they are in fact not, because the consumer still must pay the mobile data costs.

This may be a relatively minor issue in most first-world nations, where income levels are substantially higher than in South Africa.

For example, in the UK average take-home pay would work out to be approximately R41,000 per month in SA. (Net Salary Calculator).

Therefore, a typical R99 out of bundle charge for a gigabyte of movies and messaging is small change.

But in South Africa, where we have well over 15 million people earning less than R200 per day, you can see that these ‘free’ apps are anything but free at all. (Source Businesstech & The Conversation)

So, the real problem in South Africa isn’t so much that data costs are high, compared to other countries. It’s the fact that they are high compared to the actual income earnt by most of the population.

This is why it’s common for millions to swap sims throughout the day and actively seek opportunities to access hotspots or other data related deals.

However, I think the real eureka moment for Moya founder, Gour Lentell, came when he discovered that most South Africans would only ever have a maximum of five apps on their devices.

If you are wondering why think back to those moments when you seem to have lost data?

More likely than not, you didn’t lose it, you just unknowingly used it, because of some data-intensive background task, which you’d forgotten to set to Wi-Fi only.

If I was earning R200 per day, I wouldn’t risk missing a setting and would also make sure I had as few apps as possible!

Interestingly, when Gour told me about this discovery, I had my own eureka moment as the reason for slow banking app adoption suddenly became clearer.

I’d always assumed it was a "we don’t trust banks" and/or "banks are expensive" type issue.

Perhaps that’s still partly true, but I suspect the reality is more the fact that if you have a choice between spending money on data to communicate v’s a banking app, you’ll choose communication.

All of this brings me to why Datafree, the company founded by Gour Lentell that runs Moya, should not simply be compared with messaging apps like WhatsApp.

It’s actually an ecosystem, where end users are able to use hundreds of digital services within Moya, without incurring any data costs at all.

Interestingly the technology that enables this, reverse billing, has been around for a while now and for some reason the owners of WhatsApp, WeChat and Telegram have seemingly chosen to ignore the opportunity it provides to service a segment of the market that globally most consist of hundreds of millions of people.

What could all this mean for the future of Moya App?

Well, certainly their messaging service may well overtake WhatsApp’s userbase in the coming years.

But it could be that this is the start of creating an ecosystem in Africa, that replicates the one created by the likes of WeChat and Alipay in China.

That would be a single uber-app, where you can pay street vendors using a qr code (with no fees), take out a micro-loans, allow gps tracking so your favourite restaurant can prepare your food just in time for your arrival and access a million and one other services we didn’t even know we needed!

The below chart shows just how rapid the growth was, for the payments component of these super apps.

That's what excites me most about Moya.

By correctly identifying the end users' problem (cost), by finding a solution with technology (reverse billing) and then thinking about the best rollout strategy of various features (e.g. messaging, banking, search, content etc. etc.) there is a real possibility that the current 6.5 million South African userbase will scale exponentially over the coming years.

And if they sustain this first-mover advantage it will not be easy for others to catch up.

I’m super excited about the possibilities and can’t wait to ask Gour as many questions as is humanly possible in a one-hour live webinar.

And I really hope you can join too.

It’ll be hosted on zoom, on the 08 March at 12:00 CAT.

I’m particularly keen to ask how he believes his latest offering, MoyaPayD, could disrupt banking and what his plans are for scaling outside of Africa. I also want to learn more about how he survived the trough of despair when his company almost went bust and he had to dismiss his entire workforce.

And most importantly, if you do join I can’t wait to make sure he answers your questions too!

So, sign up here. There is no charge, just a request you actively join the conversation!

See you soon,

Col

p.s. if you cannot join the live call, remember to sign up anyway and I'll make sure you get the recording.

Comentarios